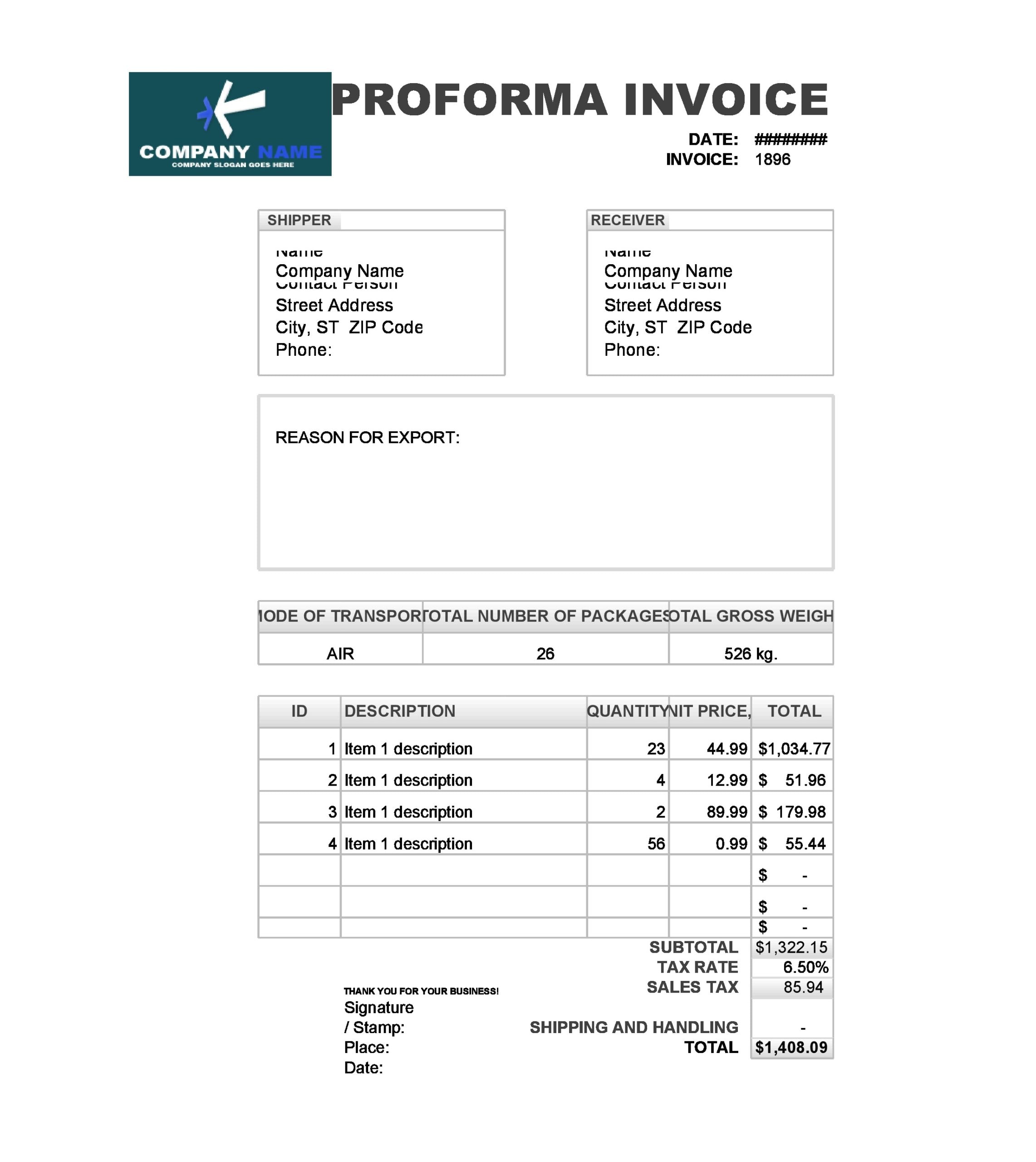

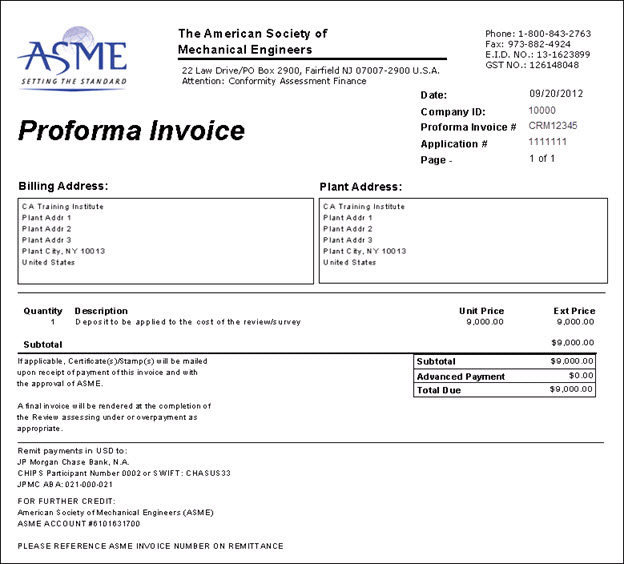

It provides an estimate of the final amount of the transaction. It informs the buyer about the amount that is due for the purchase It helps the buyer in deciding whether to place an order or not It includes the final agreed-upon details along with the demand for the final payment.īoth the buyer and seller have to make entries in their books It includes the initial price, quality, quantity, payment terms, etc., but doesn’t demand payment. It is issued after goods/services have been delivered/rendered and payment is due for the same. It is issued before the purchase order is placed. It serves the purpose of a legal document to record the export sale transaction and request final payment from the buyer. It is issued to provide the purchaser with details about the product/service he hasn’t yet received from the seller. Major differences between proforma invoice and commercial invoice Point of Difference A commercial invoice is also the document issued by the seller to confirm that the sale has occurred, allowing both parties to book the entries in their accounts. It includes information of the buyer, seller, mode of dispatch, destination, freight forwarder, price, and payment terms, among other details. A commercial invoice is a legally binding document used by the customs department to clear the shipment. It also serves as a contract as well as a proof of sale between both parties. Commercial InvoiceĪ commercial invoice is a legal document that is issued by a seller (exporter) to a buyer (importer) in case of an international business transaction. A proforma invoice is usually used in the case of importing and exporting, particularly when both the buyer and the seller do not have any prior history of business together. Once the parties agree to the details, the seller delivers the goods and issues the final invoice. The key point to remember here is that the seller sends a proforma to the buyer when they’ve committed to purchase, but this can’t be considered the final invoice as details still need to be confirmed by both parties. A proforma invoice is fundamentally a “good faith” agreement between a buyer and a seller, enabling the buyer to know what to expect before placing the order. Simply put, proforma invoice documents the sale terms, however, it does not demand any payment. It includes details such as the price, quality, quantity, delivery terms, etc.

#PROFORMA BILL MEANING PRO#

The process for preparing a pro forma income statement, balance sheet, or cash flow statement is similar to preparing the standard version of the documents. There are three types of pro forma statements:Įach type shows a different view of the economic effects of a specific event or business decision. What Is a Pro Forma Statement?Ī pro forma financial statement is a written prediction of a company or property's future revenues and expenses based on past experiences and future projections. Pro forma financial statements do not need to follow the strictest accounting standards and should only be considered as estimates. Likewise, in real estate settings, pro forma helps investors assess a property's future value. Pro forma is a legal term that translated from the Latin means "for the sake of form" or "as a matter of form." The term is used to refer to a method of calculating financial projections and to the documents or invoices that result from the process.Ī pro forma financial statement can help business owners evaluate a corporation or company's potential, so they can make informed decisions.

0 kommentar(er)

0 kommentar(er)